Overview

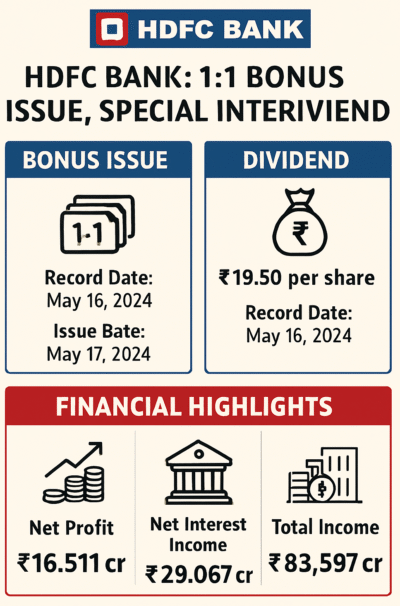

HDFC Bank, India’s largest private sector lender, has declared its first-ever bonus issue of shares in a landmark move aimed at rewarding shareholders and bolstering investor sentiment. Alongside this, the bank has also announced a special interim dividend, enhancing its appeal to both retail and institutional investors.

Key Highlights

1:1 Bonus Share Issue

- Ratio: Shareholders will receive 1 bonus share for every 1 fully paid-up equity share held as of the record date.

- Record Date: The eligibility cut-off for receiving the bonus shares is August 27, 2025.

- Number of Shares: The bank will issue approximately 76.68 crore bonus shares of face value ₹1 each, potentially increasing its paid-up share capital from ₹766.79 crore to ₹1,533.58 crore.

- Share Allotment: Bonus shares are expected to be credited to eligible shareholders’ accounts by September 18, 2025, which is within two months from board approval.

- Historic Nature: This marks the first bonus issue in HDFC Bank’s history since its listing in 1995.

Special Interim Dividend

- Dividend Amount: A special interim dividend of ₹5 per equity share (face value ₹1) has been declared, amounting to a 500% payout for FY26.

- Record Date: The cut-off for dividend eligibility is July 25, 2025.

- Payment Date: The dividend is scheduled to be paid on August 11, 2025 to eligible shareholders.

Financial Performance Context

The announcements came as HDFC Bank reported strong results for Q1 FY26:

- Net Profit: Rose to ₹18,155 crore, a 12% year-on-year increase.

- Interest Income: Increased by 6% to ₹77,470 crore.

- Net Interest Margin (NIM): Stood at 3.35%, slightly lower year-over-year due to deposit repricing.

- Cost Control: The bank maintained an efficient cost-to-income ratio despite rising expenses, showcasing resilience.

Strategic Implications

- Shareholder Reward: The bonus issue and dividend together represent a substantial benefit to HDFC Bank shareholders, reinforcing the bank’s commitment to value creation.

- Market Impact: These moves are likely aimed at boosting investor confidence and attracting new investments, especially as the bank continues to post solid growth amid sectoral challenges.

- Capital Structure: The bonus shares will be funded from the Securities Premium Account, for which the bank holds ample reserves.

Important Dates Table

| Event | Date |

|---|---|

| Board Approval | July 19, 2025 |

| Dividend Record Date | July 25, 2025 |

| Dividend Payment | August 11, 2025 |

| Bonus Share Record Date | August 27, 2025 |

| Bonus Allotment Deadline | September 18, 2025 |

Conclusion

HDFC Bank’s decision to approve a 1:1 bonus issue and a ₹5 special interim dividend marks a milestone in its history. The combination of robust financial performance, a shareholder-friendly payout, and strategic capital allocation positions the bank favorably for sustained growth and market leadership.

Leave a Reply